A Florida marital asset is anything of value that either spouse acquired during the marriage jointly or separately. A premarital asset you own may initially be a non-marital property, but it can become marital property in some circumstances. Without a knowledgeable divorce attorney on your side who understands the intricacies of asset valuation and distribution, you could lose your fair share.

Real Estate Divorce Assets

The division of real estate can be one of the most difficult aspects of a divorce, particularly if your primary residence is marital property. The court may order you to sell the home and divide the proceeds, award it to the parent with primary custody of the children, or award it to one party in exchange for a cash payout from the other. Any other real property either of you owns may be marital property, including the following:

- Rental properties

- Vacation homes

- Vacant land

- Timeshares

- Farms

- Commercial properties

- Apartment complexes

- Condominiums

- Oil, gas, or mineral rights

- Mobile homes permanently affixed to land

When dividing real estate, the court must consider whether selling the property will result in a capital gains tax, whether either spouse can afford the remaining mortgage payments after the divorce, and the asset’s desirability to each spouse.

Some properties may have a negative value because of the principal due on the mortgage or its condition. Rental properties may count as income streams and assets. An experienced contested divorce attorney can ensure you receive the share you deserve.

- Key Points About Real Estate Assets

- The primary residence is the most common real estate asset to be divided during a divorce, but there are many types of real estate.

- The marital home may be sold. The proceeds may be divided between the spouses or awarded to one spouse if the court determines it serves the children’s best interests or facilitates a fair and just outcome for both parties.

- The court must consider the big picture, including factors such as mortgages you owe, taxation issues, each party’s financial standing, and the income generated from any of the properties when dividing real estate.

Retirement Investments as Divorce Assets

The following benefits, rights, and funds are generally marital assets that must be equitably divided during a divorce:

- 401k accounts

- IRAs

- Pensions

- Profit-sharing benefits

- Annuities

- Deferred compensation

- Insurance plans, such as a whole life insurance policy

- Military benefits if either party served at least 10 years

Retirement accounts can be difficult to value. Do not withdraw money or close any retirement accounts before talking with an attorney. Doing so could appear as an attempt to hide assets and defraud the other party, causing disfavor with the court. Additionally, you could incur substantial tax penalties if you withdraw funds from a 401K or IRA account before you reach 59 and a half.

- Key Points About Retirement Funds During Divorce

- Retirement accounts that accumulate value during your marriage count as marital assets subject to equitable division.

- Retirement accounts are especially difficult to value due to their unique circumstances.

- Do not change your retirement accounts without first consulting a knowledgeable divorce lawyer.

- Key Points About Liquid Assets

- Liquid assets are generally easier to divide than other assets.

- Dividing liquid assets can be complicated in cases involving stocks, bonds, precious metals, and other assets that earn interest or dividends or otherwise increase in value.

- Keeping your accounts separate from your spouse’s accounts does not always prevent them from becoming marital property.

Liquid Divorce Assets

Liquid assets include cash or anything you can quickly convert to cash, such as the following:

- Checking accounts

- Savings accounts

- Cash in safe deposit boxes

- Money market accounts

- Cash under the mattress

- Stocks and bonds

- Certificates of deposit, or CDs

- Mutual funds

- Accounts receivable for businesses

- Treasury bills and notes

- Gold and precious metals

- Foreign currency

The value of liquid assets is easier to determine than that of many other assets, but sometimes it can become complicated. Some liquid assets may not be immediately available for withdrawal, and some draw interest or appreciate over time. The value of gold, precious metals, and foreign currency can change daily.

Many people mistakenly think their liquid assets are immune from equitable distribution if they keep them in separate accounts. However, liquid assets can become marital property if they are commingled with marital funds or used for the benefit of both spouses.

Vehicle Divorce Assets

If you and your spouse each own a car, dividing vehicles is easy: You most likely can keep your own car. However, if you share a vehicle or own other vehicles, it can become a point of tension. The court must consider how each spouse benefits from each vehicle and the consequences of awarding a particular vehicle to the other.

When you think of vehicles, you may think of cars, trucks, and SUVs, but the division of vehicles also may include:

- Recreational vehicles

- Campers

- Mobile homes not permanently affixed to land

- Motorcycles

- Scooters

- ATVs

- Boats

- Airplanes

- Jet skis

- Key Points About Vehicles as Divorce Assets

- Even if a vehicle is in your name, if you acquired it during the marriage, invested marital funds into it, or used it for your mutual benefit, it is likely marital property.

- If you have multiple vehicles, the court will generally award an equal share to both spouses based on the vehicles’ value unless there is a good reason to award more to one spouse.

- If it is impossible to divide the vehicles in a way that would be fair to both parties, the court may require the sale of some vehicles and divide the proceeds between spouses.

Personal Assets

The court will generally allow you to keep your personal effects, such as clothing and items that hold no value to the other spouse. However, some personal items have monetary value or will require replacement by whichever spouse does not keep them. The following personal assets are marital property that may be divisible in a divorce settlement:

- Expensive jewelry

- Designer clothing and handbags

- Collections

- Books

- Video games

- Mobile devices

- Computers

- Furniture

- Household items

- Musical instruments

- Antiques

- Sports equipment

- Exercise equipment

- Lawn care equipment

- Farm equipment

- Artwork

- Tools

- Gifts you received from each other

The court will consider the cost of replacing items that must be reacquired as well as each item’s monetary value.

- Key Points About Personal Assets

- You may need an appraisal to determine a personal item’s value for the purpose of fair property division.

- The court must consider the cost of replacing everyday items.

- You will likely get to keep your clothing and other personal items, except expensive items such as jewelry, which may be divisible.

- Gifts from your spouse during the marriage are marital property.

- Key Points About Digital Divorce Assets

- Although not physical, digital assets must be included in an equitable distribution of assets in a divorce.

- Digital assets may be divided between the spouses or sold so the spouses can share the proceeds in a manner the court determines to be fair.

- Some digital assets may be sentimental, making them difficult to value.

Digital Divorce Assets

A digital asset is anything of value that is created and stored in an electronic format. Digital assets may be stored on a computer, flash drive, server, or “in the cloud.” Digital assets can carry significant monetary value and may count as marital property. Examples of digital assets include the following:

- Profitable websites

- Domain names

- Intellectual property

- Digital artwork

- Monetized social media accounts

- An e-commerce business

- Cryptocurrency

- Ebooks

- Manuscripts

- Photos

- Databases

- Documents

- Music

- Videos

- Email accounts

- Gaming accounts

- Animations

- Illustrations

- Security tokens

Digital assets, such as cryptocurrency, are sometimes divisible between spouses. A court could order the sale of some assets, such as a profit-generating website, to split the proceeds between spouses.

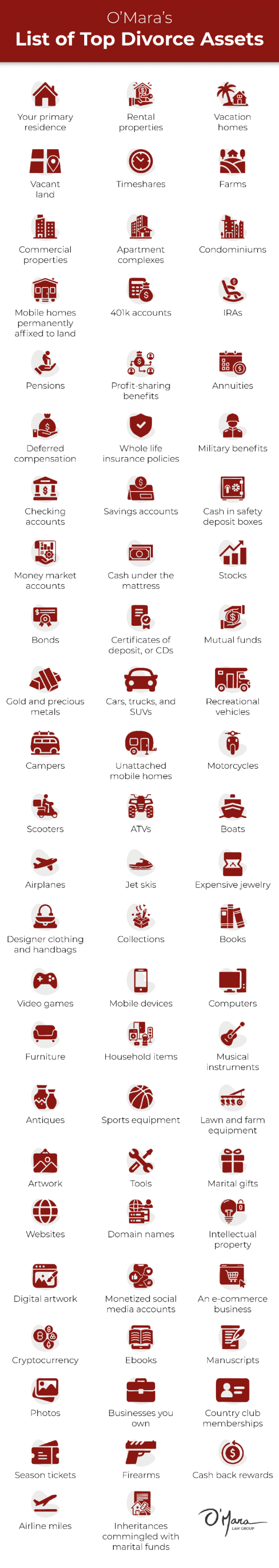

O’Mara’s List of Top Divorce Assets

- Your primary residence

- Rental properties

- Vacation homes

- Vacant land

- Timeshares

- Farms

- Commercial properties

- Apartment complexes

- Condominiums

- Mobile homes permanently affixed to land

- 401k accounts

- IRAs

- Pensions

- Profit-sharing benefits

- Annuities

- Deferred compensation

- Whole life insurance policies

- Military benefits

- Checking accounts

- Savings accounts

- Cash in safety deposit boxes

- Money market accounts

- Cash under the mattress

- Stocks

- Bonds

- Certificates of deposit, or CDs

- Mutual funds

- Gold and precious metals

- Cars, trucks, and SUVs

- Recreational vehicles

- Campers

- Unattached mobile homes

- Motorcycles

- Scooters

- ATVs

- Boats

- Airplanes

- Jet skis

- Expensive jewelry

- Designer clothing and handbags

- Collections

- Books

- Video games

- Mobile devices

- Computers

- Furniture

- Household items

- Musical instruments

- Antiques

- Sports equipment

- Lawn and farm equipment

- Artwork

- Tools

- Marital gifts

- Websites

- Domain names

- Intellectual property

- Digital artwork

- Monetized social media accounts

- An e-commerce business

- Cryptocurrency

- Ebooks

- Manuscripts

- Photos

- Businesses you own

- Country club memberships

- Season tickets

- Firearms

- Cash back rewards

- Airline miles

- Inheritances commingled with marital funds

Why Choose O’Mara Law Group For Your Divorce

Our award-winning divorce attorneys are board-certified in Florida Marital and Family Law and have decades of experience negotiating complex divorce settlements. Our founder, Mark O’Mara, has practiced law since 1982 and has earned the coveted Martindale-Hubbell A.V. Preeminent rating for legal skill and ethics.

We regularly receive five-star client reviews due to our compassionate client support and the exceptional results we achieve. We can protect your assets and ensure you receive fair treatment during your divorce.

Contact us online today or call (407) 634-6604 to schedule a consultation with one of our knowledgeable divorce lawyers.