Welcome to the O'Mara Law Group

Orlando Criminal Defense & Family Law Firm

Orlando Criminal Defense & Family Law Firm

Double-Board Certified

Mark O'Mara is certified in both Criminal Trial Law and Marital & Family Law.

Voice for Justice

Advocating for change in over-prosecution and sentencing laws.

Legal Analyst

Providing expert commentary on high-profile legal cases.

Leadership

Regular lecturer at institutions including Harvard Law School.

At O'Mara Law Group, we specialize in providing personalized legal strategies that align with the specific needs of our diverse clients.

Our criminal defense clients benefit from swift, expert representation designed to achieve the best possible outcome, even in high-pressure situations. Our team is committed to delivering exceptional results with a strategic, client-focused approach.

Learn More about Criminal Defense

For high-net-worth individuals navigating family law matters, we offer the utmost privacy, discretion, and financial protection. Our team is committed to delivering exceptional results with a strategic, client-focused approach.

Learn More about Family Law

Double-board certified in criminal defense and family law, Mark O’Mara brings his legal insights to major networks like CNN, FOX, and CourtTV. His thought leadership in high-profile cases has established him as a trusted voice in national and regional media.

As Seen On National & Regional Media

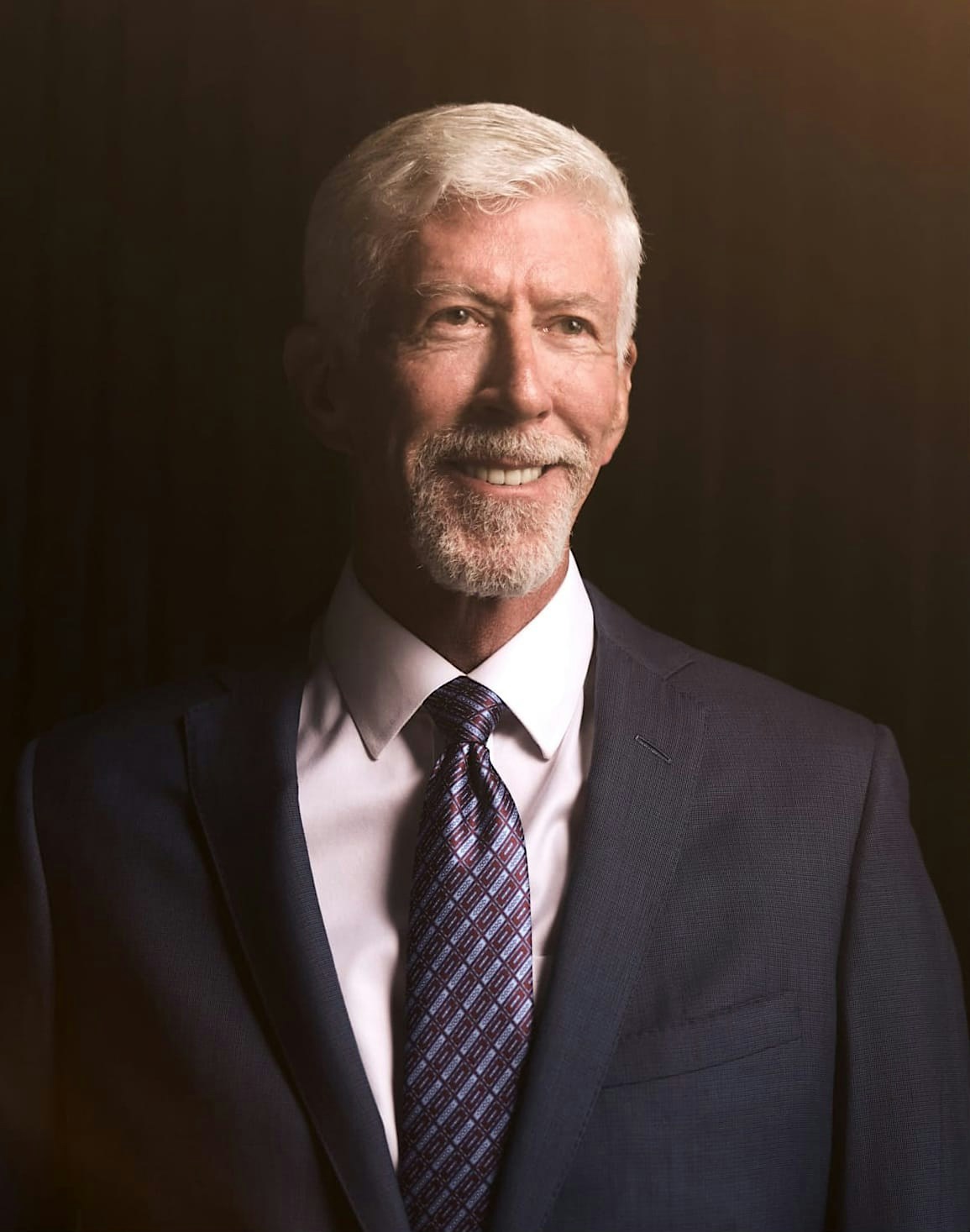

Mark O'Mara

The Mark O’Mara Law Firm was a wonderful place and outstanding. Mark was very helpful and always made time for me, answering all my questions. But my hero was Susan Staggs, who prepared all of my paperwork. She is a real magician who takes it seriously.

Mark O'Mara and his office provided excellent service, demonstrating professionalism and personal attention to all my details of my cases. He is one of the best in his field as a criminal and family attorney. He is honest, direct, and he always does his best for his client.

Mr. O’Mara and his entire staff, especially Alyssa, were absolutely impressive with everything. Very efficient and punctual; their understanding of every little detail was way beyond expectations. Honestly, this law group has made a major difference in my life.

I can't thank Mr. Thompson and his team enough for their outstanding support. From the very first meeting, Sarah was incredibly knowledgeable and attentive. They handled every aspect of my case with such professionalism and care. This legal team truly changed my life.

Knowing Mark O’Mara as an attorney who has represented me for the past 23 years and has also been a friend… I can say that Mark is not only dedicated to fighting your cause, but his team shares that same dedication. When you call his office the girls at the front desk always strive to assist you. As for the rest of his team they are committed to winning the best...

Mr O’Mara and the entire staff were nothing short of amazing. Mr. O’Mara knew exactly what we needed to do and has even offered additional advice for any future risks. This was all new for me and they walked me through everything step by step and were very patient and most of all responsive and caring. THANK YOU!!!

I cannot express the gratitude I have for Mark O’Mara, Susan and their firm. I had a very difficult custody situation and they guided me towards the best decisions and fought for me. I highly recommend O’Mara Law Group. They are top notch!!!!

Such a professional and personable firm. Everyone treated me with respect throughout my entire process. I absolutely dread ever needing the services of an attorney again but I would certainly go straight back to Mark. Susan was awesome and she totally got me from day one. I can’t begin to say how helpful that was for me. Thank you to the entire team!!

By far, the best person, if you ever need an attorney and someone who will always be there for you. I am truly proud to have Mark as my attorney, advisor and friend. Thanks Mark and Alyssa. Michael Hoffman, Attorney at Law and C.P.A.

Mr. O’Mara and his entire staff especially Alyssa were absolutely impressive with everything. Very efficient and punctual and the overall understanding of every little detail was way beyond expectations. Honestly this law group has made a major difference in my life and helped me through many obstacles associated with owning multiple businesses and continue to do so in...

When I went in for my consultation with Mark and Caitlin, I was in a state of total devastation. They lifted the burden and took away the stress of my situation by making me feel completely taken care of. They were ready to fight the fight I didn’t have the emotional strength to do so on my own. I have and will continue to recommend their law group to anyone needing le...

Mark has represented me and I hate to say 2 family members of mine, all 3 times mark has delivered success. He has to be the best lawyer I have ever dealt with, he is caring of the situation and of your fears in facing legal matters , he made us feel comfortable , safe and protected. Surprisingly he never made me feel down on myself for stupid things I created that lead to h...

Mark O'Mara is unique in Florida as the only attorney certified by the Florida Bar as a double-board certified attorney in Criminal Trial Law and Family Law.

As a Supreme Court Certified Family Mediator and Circuit Civil Mediator, he has more than 40 years of experience. Recognized nationally, Mark's dedication to legal excellence and client advocacy has earned him a place among the top 100 lawyers in the U.S.

Mark O'Mara

At O'Mara Law Group, our strength lies in the expertise and dedication of our team.

Led by Mark O'Mara, our attorneys and staff bring decades of experience across a range of legal disciplines, including Mass Torts, Criminal Defense, and Family Law. We work collaboratively to provide personalized legal solutions tailored to each client’s unique needs, ensuring that every case is handled with care, precision, and strategic foresight.

Mark M. O’Mara is a well-known figure in the legal community in Central Florida. He often appears on CNN as a respected legal analyst. Mr. O’Mara is arguably among the most talented attorneys in Orlando, Central Florida, and the nation.

Bert Barclay and Mark O’Mara are friends who have worked together for over three decades. They share a mutual respect for their skills in the legal arena. Bert is a Central Florida native. He is a highly experienced and respected family law and crimin...

Brittany M. Staggs is a Managing Attorney at the O’Mara Law Group with extensive experience in criminal and family law. Brittany provides exceptional support for clients as she navigates them through complex legal matters. Fluent in both English and S...

Christopher Lillard Smith brings over 40 years of legal experience to the O’Mara Law Group. A graduate of the University of Florida’s Fredric G. Levin College of Law, Chris has dedicated his career to providing strategic and effective representa...

Don't ask me how they did it, but I went from facing 'decades' to doing only 18 months... they gave me my freedom back when I thought I was a goner.

L.D.The criminal defense team at O'Mara Law Group is committed to protecting your rights and ensuring the best possible outcome for your case. Whether it's navigating trial litigation or negotiating plea agreements, we offer robust legal representation with a focus on your future and freedoms.

With over 40 years of experience, Mark O'Mara's criminal defense team is nationally recognized for legal excellence and client advocacy, ranking among the top 100 lawyers in the U.S.

Your Team

Led by a highly experienced criminal defense team.

Our Commitment

Committed to protecting clients’ rights and securing the best outcomes.

Mark really fights for what YOU want out of your case and makes sure you get it! His paralegal Susan spent countless hours going over specifics with me and guiding with what I needed.

M.L.At O'Mara Law Group, our family law team delivers compassionate and strategic support for families facing complex legal challenges. With expertise in divorce, child custody, and financial disputes, we offer personalized solutions that protect your assets and relationships.

O'Mara Law firm has been a trusted ally in family law matters, providing expert guidance and support to help clients navigate challenging legal issues.

Certified

Supreme Court Certified Family Mediators and Circuit Civil Mediators.

Expertise

Expertise in high-net-worth divorces and complex financial disputes.

When it comes to legal defense, experience counts more than anything. The talented members of the O’Mara Law Group offer our clients an extensive degree of experience when it comes to criminal defense, but our recognition doesn’t stop there. We’re frequently called upon to collaborate with other law firms, aiding them in their quest to protect the rights and dignity of those who deserve it most.

If you’re a referring attorney and you’d like to learn about how O’Mara Law Group can help you address your clients’ needs, reach out to us and speak with a team member today.

Contact UsHigh-stakes cases including felonies, white-collar crimes, and complex appeals.

High-net-worth divorces, child custody disputes, and intricate financial settlements.

Litigation against large corporations for dangerous products or deceptive practices.

Expert insights for legal professionals and the public on cutting-edge approaches in Mass Torts, Criminal Defense, and Divorce.

The O’Mara Law Group stays ahead of the game by keeping current on the latest tactics and maintaining an intimate understanding of both state and federal statues.

The rapid expansion and accessibility of technology, social media, and internet access has enabled it to become common practice for people to publish sexually explicit images of an...

An injunction is a court order that may be issued either to prevent or stop someone from doing something or compel someone to do something. A domestic violence injunction is an ord...

In the State of Florida Pre-trial Diversion (PTD), also commonly referred to as Pre-trial Intervention (PTI), is an alternative prosecution program that is structured by the county...

Florida Family Law Rules of Procedure Form 12.941(d) may be used by a parent or guardian to file an emergency verified motion for child pick-up order. However, this form should onl...

A criminal conviction in the state of Florida has collateral consequences which may affect employment opportunities, educational opportunities, housing, and even firearm rights. Th...